How we are different

Empowerment with Enhanced Security

Employing our software through the API plugin puts you in the drivers seat, offering complete autonomy over your accounts. Your funds remain entirely under your control; we never handle your money or exert any influence over your personal finances. You have the freedom and peace of mind to activate or deactivate the software at your convenience.

Precision in Trend Identification

Our approach is not based on simple buy and hold conviction plays. Instead, our algorithm is tailored to monitor and trade the most prominent Altcoin momentum shifts, unaffected by typical counter productive investor emotions.

Pioneering Fintech Advancement

Benefit from rapid execution facilitated by our non-emotive trading systems, driven by advanced algorithms. We are committed to leading the way in fintech, guaranteeing you access to state-of-the-art technology to help enhance your trading performance.

Solutions

The Case for Investing in Altcoins in 2024

The Altcoin market is currently undervalued on a relative basis, and there are many compelling reasons why investing in Altcoins in 2024 presents a promising opportunity with high-potential growth.

Unlocking Altcoin Potential: The Role of BTC Halving in Your Investment Strategy

BTC Halving: BTC halving occurs every four years and historically leads to a significant increase in BTC and Altcoin prices. Halving reduces the supply of new BTC, which in turn drives up demand for the cryptocurrency. This pattern typically leads to Altcoin markets following BTC trends, historically creating a surge in value with the same expected from the 2024 halving.

The average accumulated return of the “Top 50” Altcoins by market cap after each BTC halving event:

- First halving (2012): 727%

- Second halving (2016): 2,359%

- Third halving (2020): 604%

- Overall average: 1,580%

The average accumulated return of the Altcoin market as a “whole” after each BTC halving event:

- First halving (2012): 5,900%

- Second halving (2016): 13,023%

- Third halving (2020): 933%

- Overall average: 7,733%

From Wall Street to Crypto: The Game-Changing Impact of BTC ETF Accessibility

Expected Approval of a BTC ETF: The approval of a BTC Exchange-Traded Fund (ETF) from the likes of Blackrock or Fidelity by the SEC would make it easier for retail investors to invest in Bitcoin. This increased accessibility can not be underestimated as it will open the crypto market to a much wider retail audience which previously had difficulties to enter via investment portfolios. The result will be a significant rise in demand for BTC, and an overall significant increase in Crypto Market Cap. If we see Current Market Cap versus Previous Market Cap it shows we now have a potential large increase coming should the current applications for a retail ETF for BTC be approved in the coming months.

Quoting just one example we now have Standard Chartered Bank predicting a price of 120,000 USD per BTC by year end 2024.

https://www.reuters.com/technology/standard-chartered-bumps-up-bitcoin-forecast-120000-2023-07-10/Clearer Horizons, Brighter Future: Crypto Regulation as Catalyst for Growth

Increasing Regulation of the Crypto Market: As the crypto market becomes more regulated, investor confidence grows. Increased regulation provides a sense of security and transparency, attracting more investors to the market. A recent example of this is XRP ruling in the US designating XRP sold to individuals as being not a security, but those sold to Institutional investors as being under the SEC remit and considered a security. Further regulatory clarity will see similar if not greater surges in investment that could have a positive impact on Altcoins, driving their prices higher.

Below we see the current sentiment for BTC which will only improve with a further clearer regulatory framework.

Charting New Waters: Altcoin Prospects Soar as Institutions Dive into Crypto

Increased Capital Inflow from Institutional Investors: Increasingly recognizing the potential of the crypto market, if these investors start to allocate funds to altcoins it will result in a substantial increase in overall market capitalization. Institutions like BlackRock and Fidelity entering the market with plans to launch BTC ETFs, would bring considerable institutional capital into the market and drive up Altcoin prices as investment portfolios are diversified to capitalise on the overall market. The potential inflows from such institutions should not be underestimated.

See below capital under management of the worlds largest assets managers, including some that are preparing BTC ETFs for their retail investors and the potential for increased Market Cap becomes obvious with only a small percentage allocation:

Unlocking Altcoin Momentum: The Advantage of Timing BTC Dominance Shifts

BTC Dominance - Opportunity? In addition to these fundamental factors, technical analysis also suggests that the Altcoin market is poised for growth in 2024. The Altcoin market has been in a downtrend since the last bull market, with BTC taking significant market share. But signs of a reversal are emerging. Currently trading at a significant discount to its all-time highs, the Altcoin market presents an intriguing buying opportunity for momentum focused investors.

Current BTC Crypto Market Dominance versus the drop in Dominance in the last Altcoin Bull Run:

Previous Dominance before the drop in previous ALtcoin Bull Run:

Investor Empowerment: How Falling Interest Rates Reshape the Crypto Opportunity

How will Interest Rates affect crypto? Ourselves along with many other analysts, now envisage a falling interest rate in 2024 which will allow both large cap traders and retail investors to once again use leverage as part of their investment strategy. Current interest rates have forced many investors to reduce their positions (including withdrawing from crypto assets) as the costs of leveraging became prohibitive.

However as inflation continues to fall we can now safely summarise that the FED will commence a reduction in interest rates cycle from April 2024 onwards, allowing investors to once again leverage their portfolios and most certainly use some of their additional capital for Alternative investments such as Crypto, providing yet another inflow of capital to the currently depressed market.

See Fed projections and Morningstar Analyst projects for Interest Rate Reductions cycle commencing 2024:

Reclaiming Financial Independence: Interest Rate Reductions Open Doors to Crypto

“Momma & Poppa” investors: A final yet fundamental point to consider is the “Momma & Poppa” investors. We have seen the strength of these retail investors in conventional markets with the power to move “Meme” stocks such as AMC and others forcing traditional asset managers to “rethink” shorting strategies.

These same investors stand to gain in an interest rate reduction environment and in many instances may find themselves tens of thousands of dollars better off as they see the costs of mortgages, car repayments and credit card debt become significantly reduced. The latent effect of such a reduction in debt burden sees these types of investors (numbering in their millions) view their new found financial freedom as “free money” as it was previously used to service debt. Essentially this leads to a risk ON environment and Crypto Markets become an attractive option for investing this capital into as they attempt to clawback wealth lost from the rise in inflation over the previous years.

Altcoin Investments: Where Risk Meets Reward in a Dynamic Crypto Landscape

Risks and Opportunities: It is important to be aware of the risks involved in investing in Altcoins. The crypto market is volatile and emerging regulation could have both positive and negative impacts on prices. However, the potential rewards of investing in Altcoins are significant and we consider the risk premium to be extremely attractive and to be beyond that of typical investments. By conducting thorough research and seeking guidance from experienced financial advisors, you can navigate this exciting market and seize the chance to be part of the next big crypto cycle.

2024: Unveiling a Golden Era for Altcoin Investment and Growth

Conclusion: Considering the BTC halving, expected approval of a BTC ETF for retail investors, increasing market regulation, potential capital inflow from institutional investors, and favourable technical analysis which includes a falling interest rate environment, the Altcoin market appears poised for significant growth in 2024. Investors seeking high-potential growth opportunities should consider including Altcoins in their investment strategy. It is a very rare moment where we are seeing the stars align for an exciting opportunity in 2024.

It is important to remember the market is forward looking so being in the market BEFORE 2024 is of paramount importance to not miss the commencement of the next Bull Run.

Grey Swan: Navigating Market Cycles with Algorithmic Precision

About Grey Swan: Grey Swan is a proprietary algorithmic trading system that exploits market cycles. Backtested over the past decade, Grey Swan has consistently generated substantial profits with an impressive 11,500% return during the previous Altcoin season in 2021 which greatly surpassed returns from BTC.

If we consider the overall average return of BTC over the previous Halvings we have an Overall average: 1,580%

If we consider the overall average return of Altcoins over the previous Halvings we have an Overall average: 7,733%

Grey Swan has a demonstrable return of 11,500% over the last Altcoin Bull Run.

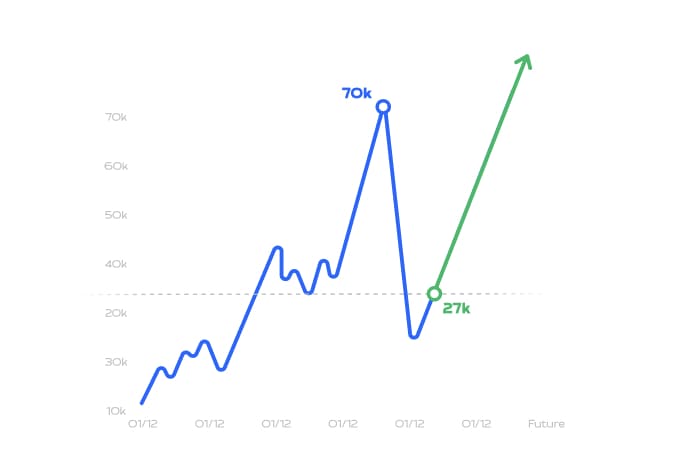

Where are we?

Market Shift Opportunity

In the world of more volatile speculative and equity markets, including BTC, there has been a notable shift over the last 18 months. This came after U.S. interest rates rose significantly over a short period of time, with prices experiencing a significant dip across equity and crypto markets, prompting a move towards fixed income assets. This however creates our opportunity for entry, with prices well below historical market highs and with a more favourable scenario emerging.

BTC Dominance Dynamics

BTC often serves as the initial entry point into the world of cryptocurrencies. Initially, BTC tends to see more rapid appreciation compared to other currencies as capital returns to the market. Altcoins, on the other hand, may remain steady, appreciate at a slower pace, or even experience some devaluation during this period of BTC Dominance.

Altcoin Momentum Dynamics

After a substantial influx of capital into the market, BTC tends to stabilize, leading to a sideways movement. At this point, altcoins tend to either follow BTCs initial trajectory or take a path of appreciation surpassing that of BTC.

Alt Season Arrival

As BTC plateaus at higher levels, investors often look for new avenues to capitalize on. This is when we see the market dominance of BTC diminish after experiencing its initial surge in appreciation. As BTC Dominance diminishes, historically this marks the beginning of an "alt season," signifying an optimal phase for our strategy. Altcoins, with their smaller market value, tend to experience a much more pronounced appreciation trajectory with each influx of capital, resulting in profits typically surpassing those of BTC.

Rate Cut Rally

The anticipated trigger for reigniting the markets upward trajectory is the reduction of interest rates in the U.S. which is anticipated in 2024. This moment holds the potential for a substantial surge away from fixed income assets. Historically, lowering interest rates in the U.S. has led to an influx of capital into the more volatile equity and crypto markets.

Real account results

An example from an active account, operational exclusively during the altseason period in the past crypto market uptren

- A remarkable 11,500% return in contrast to BTC's 196%.

- Over $45,000 in profit in just a single day.

Who are we?

JuvenalGaleno

With over 8 years experience working in the crypto markets, Juvenal should be considered a veteran in the emerging world of cryptocurrencies. With a depth of experience in project development and algorithmic trading in the Crypto Markets he will lead the software development teams in implementing our successful trading strategies.

SimonCousins

As a current Director of Blue Tower International, Simon has been actively engaged in the financial markets since the early 2000s, accumulating over 20 years of experience working with varying traditional financial instruments. He brings the expertise of running and coordinating a successful project from the ground up, considering the structures needed and tax efficient planning required for todays evolving landscapes.

Are we seeing the final pieces of the crypto jigsaw put into place?

During the 2013 bull run, Crypto assets were primarily held by a select group of tech-focused investors. The 2017 bull run left many regretting their late entry into the Crypto world. During the 2021 Bull Run, the industry's cry for enhanced regulation and improved retail investor access through ETFs became prominent.

Looking ahead to 2024, a pivotal year is on the horizon. With a more extensive investor base, the prospective launch of institutional ETF funds,emerging regulatory clarity, and the forthcoming FINAL BTC halving, the stage is set for a significant opportunity. Combine this with projected interest rate reductions in 2024, and the moment to act is now. The Real Opportunity awaits TODAY.